Not known Facts About Chapter 7 Vs Chapter 13 Bankruptcy

What Does Which Type Of Bankruptcy Should You File Do?

Table of ContentsAll about Tulsa Ok Bankruptcy Specialist5 Easy Facts About Bankruptcy Law Firm Tulsa Ok ExplainedSee This Report on Experienced Bankruptcy Lawyer TulsaSee This Report on Tulsa Ok Bankruptcy AttorneyBankruptcy Law Firm Tulsa Ok Can Be Fun For Everyone

The statistics for the various other primary kind, Chapter 13, are even worse for pro se filers. (We break down the distinctions between the two enters depth below.) Suffice it to say, talk with a lawyer or more near you who's experienced with bankruptcy regulation. Right here are a couple of resources to locate them: It's easy to understand that you may be reluctant to spend for a lawyer when you're already under substantial economic stress.Several attorneys likewise provide free appointments or email Q&A s. Benefit from that. (The non-profit app Upsolve can assist you find free consultations, sources and legal assistance absolutely free.) Ask if bankruptcy is indeed the appropriate choice for your circumstance and whether they believe you'll qualify. Before you pay to file bankruptcy types and acne your credit scores report for up to ten years, examine to see if you have any practical alternatives like financial obligation settlement or charitable credit scores therapy.

Advertisement Currently that you've made a decision insolvency is certainly the best program of activity and you with any luck cleared it with an attorney you'll need to obtain begun on the documents. Prior to you dive into all the official bankruptcy forms, you ought to obtain your own records in order.

Unknown Facts About Which Type Of Bankruptcy Should You File

Later down the line, you'll really require to verify that by revealing all type of details regarding your financial events. Here's a fundamental checklist of what you'll need when driving ahead: Identifying documents like your motorist's permit and Social Security card Income tax return (up to the past 4 years) Evidence of income (pay stubs, W-2s, freelance earnings, income from assets as well as any kind of earnings from federal government advantages) Financial institution statements and/or retired life account declarations Evidence of worth of your assets, such as car and property assessment.

You'll desire to comprehend what kind of financial obligation you're attempting to fix.

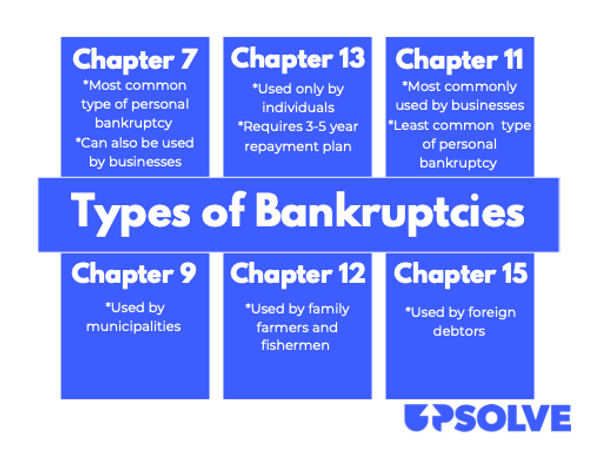

You'll desire to comprehend what kind of financial obligation you're attempting to fix.If your income is as well high, you have one more option: Chapter 13. This alternative takes longer to solve your debts due to the fact that it requires a long-lasting repayment plan normally 3 to 5 years before several of your staying financial debts are cleaned away. The declaring procedure is likewise a lot extra complex than Chapter 7.

Bankruptcy Attorney Tulsa Fundamentals Explained

A Phase 7 insolvency stays on your debt report for 10 years, whereas a Chapter 13 insolvency falls off after 7. Both have long lasting influence on your credit rating, and any new debt you get will likely include greater rate of interest. Before you submit your bankruptcy types, you have try this out to first complete a mandatory course from a credit therapy company that has actually been approved by the Division of Justice (with the notable exemption of filers in Alabama or North Carolina).

The program can be finished online, in person or over the phone. You must finish the program within 180 days of filing for bankruptcy.

How Chapter 7 - Bankruptcy Basics can Save You Time, Stress, and Money.

An attorney will commonly manage this for you. If you're filing on your own, understand that there are concerning 90 various personal bankruptcy districts. Inspect that you're filing with the proper one based on where you live. If your irreversible house has actually relocated within 180 days of loading, you ought to file in the district where you lived the higher portion of that 180-day period.

Generally, your insolvency lawyer will work with the trustee, yet you may require to send the individual records such as pay stubs, tax obligation returns, and bank account and debt card statements directly. A common misunderstanding with insolvency is that once read the full info here you submit, you can quit paying your financial obligations. While personal bankruptcy can aid you wipe out many of your unsafe financial obligations, such as overdue medical expenses or personal car loans, you'll want to maintain paying your month-to-month settlements for protected financial obligations if you desire to maintain the property.

A Biased View of Tulsa Bankruptcy Attorney

If you go to danger of repossession and have tired all other financial-relief alternatives, then applying for Phase 13 might postpone the foreclosure and assist in saving your home. Inevitably, you will still require the revenue to continue making future home loan repayments, as well as paying off any late repayments throughout your settlement plan.

The audit could delay any kind of financial obligation relief by numerous weeks. That you made it this far in the process is a suitable indication at least some of your financial debts are qualified for discharge.